Mumbai (Maharashtra) [India], June 27: Lancer Container Lines Ltd, one of the leading integrated Shipping and Logistics solution providers in India has announced its mega expansion plans for the next few years. Company aims to expand its TEU capacity to 45,000 by FY26 from nearly 20,000 in FY24 and intends to steadily grow its container inventory by incorporating 200-300 containers each month to meet rising demand. Company aims to become a fully integrated service provider, and is actively exploring opportunities to purchase a new vessel. The measures are expected to yield healthy revenue and margin growth in the coming years.

Company is actively exploring opportunities to purchase a new vessel to become a fully integrated service provider

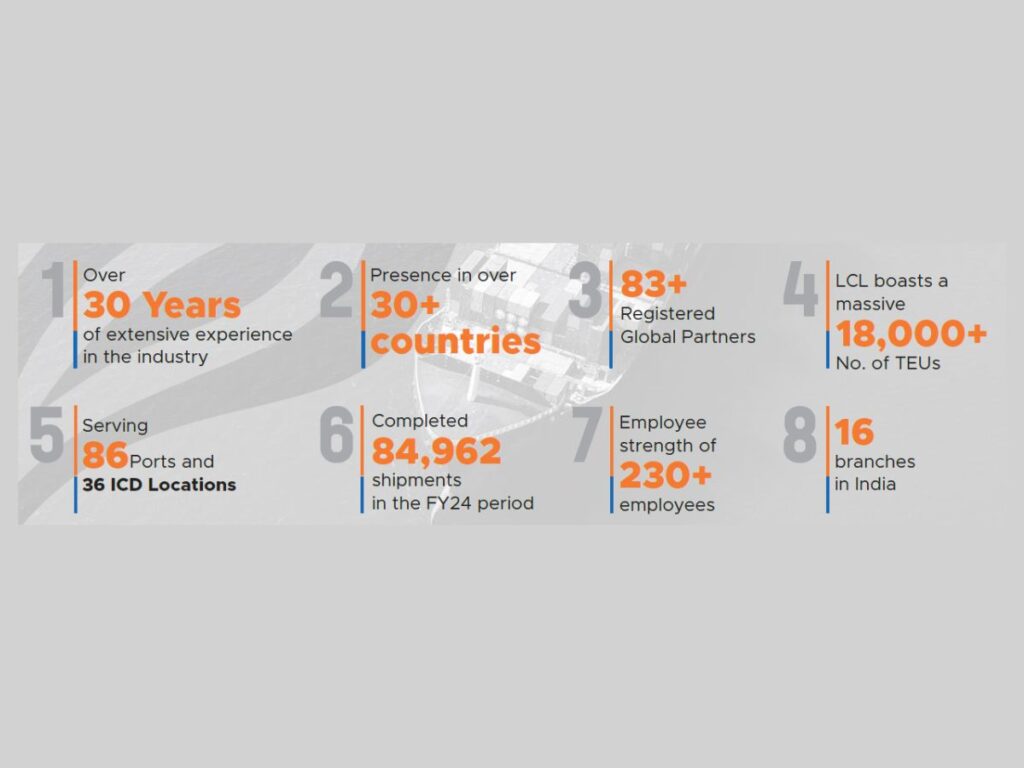

Incorporates in 2011, Lancer Container Lines Limited is engaged in providing highly integrated shipping and logistics services in India. The Company is providing services in regions like Indian Subcontinent, South East Asia, Far Coast, Mediterranean Sea, Red Sea, Black Sea, Asia, Middle East, Africa, CIS Countries, USA, Europe, and Latin America.The company has secured some of the key registrations in the global logistics domain AMTOI, FIEO, BIC France, WCA WORLD, GNN. Company has presence in over 30 countries and serve 86 ports and 36 ICD locations.

Mr. Abdul Khalik Chataiwala, Chairman and Managing Director, said, “Our focused efforts on expanding our container fleet and optimizing our service routes have led to a significant rise in the number of containers handled. The TEU volume for FY24 reached 19,699 units, reflecting an increase of 37% over the previous fiscal year. Aligned with our growth strategy, Lancer Container is poised to pursue an ambitious expansion plan, aiming to raise the TEU capacity to 45,000 by FY26. Our strategic positioning in Dubai continues to be a cornerstone of our operational strategy. The company is expanding its reach by exploring new trade routes and transporting containers to multiple destinations where there is demand for cargo.”

In the month of June 2024, company has acquired 500 TEUs, 200 each from QINGDAO CIMC CONTAINER MANUFACTURE CO. LTD and NINGBO CIMC LOGISTIC EQUIPMENT CO. LTD and 100 TEUs from SYMCON Industries Pvt Ltd. In Feb 24, Company signed contract for buying 20-feet 1200 new range of “Marine Containers”, 100 every month with SYMCON Industries Pvt Ltd. On 18 June it received the second batch of 100 brand new containers from the company , marking a significant milestone in our commitment to the ‘Make in India’ initiative. The strategic purchase underscores company’s commitment to enhancing its logistical capabilities and expanding our operational capacity in the shipping industry.

“The company remains steadfast in its commitment to achieve profitable growth which is evident as our investment increased in TEUs, sharp focus on expanding into new geographies, while establishing and enhancing stronger foothold in key operating markets, and providing comprehensive one stop logistic solutions. This growth is a testament to our strategic investments in fleet expansion and optimization of logistics operations and also underscores our capability to meet the rising demands of global trade”, said Mr. A. Khalik Chataiwala.

The Indian shipping logistics industry is one of the most important sectors for the country’s economy. The sector is experiencing significant growth, with the Indian government aiming to increase the share of waterways transport in the overall transport mix from 6% to 12% by 2025. The Indian government has launched several initiatives to boost the shipping logistics industry, including LEADS (Logistics Ease Across Different States) initiative that aims to create a single-window online platform to provide end-to-end logistics solutions, including transport, warehousing, and value-added services. The government has also implemented subsidy schemes to promote Indian shipping companies, including the 12% subsidy on Indian-built and flagged vessels and a subsidy on shipbuilding and ship repair.

For the FY24, company has reported total revenue of Rs. 646.8 crore, EBITDA of Rs. 88.1 crore (EBITDA Margin 13.9%) and Net Profit of Rs. 58.3 crore (PAT Margin 9.2%). EBITDA and PAT margin rise of 320 bps and 280 bps respectively in FY24 highlights improvement in operational and financial matrix of the company.

If you have any objection to this press release content, kindly contact [email protected] to notify us. We will respond and rectify the situation in the next 24 hours.